ICOs do seem to favour ETH. But I have seen other currencies accepted, bitcoin, litecoin, ripple. So what you wrote about ICOs pumping the price of ETH applies to those other currencies too right?

The biggest ICO so far, Tezos, raised:

- 66,000 BTC or 223,500,000 USD

- 361,000 ETH or 113,000,000 USD

(At current exchange rates - was only 200m at the time of ICO)

Without these new start-ups, their ICOs and their blockchain applications, what exactly is the point of Bitcoin? Strip all that away and you've got two uses for Bitcoin:

1. International money transfers

2. Illegal activities online

And we'll see companies like IBM developing their own platforms where cryptocurrencies are not required. www.ibm.com/blockchain/hyperledger

ICOs do seem to favour ETH. But I have seen other currencies accepted, bitcoin, litecoin, ripple. So what you wrote about ICOs pumping the price of ETH applies to those other currencies too right?

And if $USD are used to buy the BTC that is used to buy the ICOs does that pump the $USD too?

Without these new start-ups, their ICOs and their blockchain applications, what exactly is the point of Bitcoin?

It's an experimental currency.

Note that you can build smart contracts on Bitcoin, but nowhere near as easily as on Ethereum. Smart contracts will, as far as I can understand, be used as a part of the upcoming Lightning thingy for example. Bitcoin didn't go in the direction of Ethereum because simplicity = stability and security. Ethereum blockchain has a different purpose to the Bitcoin blockchain. Apples and Oranges.

If 99% of ICOs fail then you'll need to invest in 100 to find 1 that is successful. It will have to give you a 10,000% return to break even.

That's not impossible. Not at all. It'd be interesting to just put $1 on all of them.

Apologies everyone about carrying this topic on and on. It's all a bit dry and technical, and not fun at all. I hope you've enjoyed the funny images thread and the windsurfing caption competition ; )

****ing Ethereum...

From github.com/ethereum/wiki/wiki/Ethereum-Development-Tutorial

Gas

One important aspect of the way the EVM works is that every single operation that is executed inside the EVM is actually simultaneously executed by every full node. This is a necessary component of the Ethereum 1.0 consensus model, and has the benefit that any contract on the EVM can call any other contract at almost zero cost, but also has the drawback that computational steps on the EVM are very expensive. Roughly, a good heuristic to use is that you will not be able to do anything on the EVM that you cannot do on a smartphone from 1999.

EVM is the Ethereum Virtual Machine. Just like Java or VMWare or VirtualBox the EVM is apparently (even this is in doubt) a real, turing-complete virtual machine. A computer inside a computer. A software computer. Hardware written in software.

The difference with the Ethereum VM is that every node on the Ethereum executes the code; simultaneously; a distributed virtual machine.

Note that each step in logic is a transaction (bob pays alice) and comes with a transaction cost. You pay for computation using gas. While this encourages efficient code it still comes with a price for every computation. It's a rather unique model to say the least. Untested of course.

I have to admit this is ****ing mind-blowing. Really. It's ambitious to a level never seen before. It reads like a sci-fi creation. It's quite possibly genius.

But man oh man is it inefficient ("every single operation that is executed inside the EVM is actually simultaneously executed by every full node"), unproven, and quite possibly completely useless.

That said, as an investment and/or trade, you might do very, very well riding the hype bubble. But it is, mostly, a hype bubble.

Haha... like just ... tell me I'm not going mad here. Is this a joke?

This is DNT to BTC the last few days.

BTC is bitcoin. DNT is districtOx. "A network of decentralized markets and communities. Create, operate, and govern. Powered by Ethereum, Aragon, and IPFS." district0x.io

DNT has gone up 300% against BTC in the last 12 hours or so. So I had to find out what it actually was.

Here's the current (and only) feature community on districtOx; Ethlance. ethlance.com

It's a freelance job site. 1) We don't need another one, 2) you can get paid in ether on any job site if you want, 3) who want to pay or get paid in ether it being so ****ing volatile? By the time you finish the task it may have dropped or climbed 50% or more.

Here's where I lost it:

memefactory.io

"Coming soon to the district0x Network. Create and trade provably rare digital assets on the Ethereum blockchain."

Provably rare digital assets? Memes?

It gets worse:

"DNT is a staking token, used by holders to join districts and participate in their governance. Basically, you become a "shareholder" of the district if you stake your DNT in it.Once you stake your DNT in a district, you receive voting shares in that district's Aragon entity, which are used to determine everything from a district's branding and design, to the way in which they choose to attempt to monetize, to how any revenue generated is distributed or utilized.Hence, token holders can share the profits generated by the districts that they have stake in."

So you don't even get a share in the overall profitability of the company, you get a profit of whatever district you have a stake in.

Maximum Market cap at ICO = $83m

Man, Ethereum is going to give all cryptos a bad, bad name. I mean how many cryptocurrencies do we even need? Answer: one. The obvious choice is Bitcoin. Everything else is a copy.

Bitcoin (BTC) price against $USD since this thread started on 31 May:

$2191 to $3717 = +70%

Or you could look at it as the $USD crashing.

It's just begun to go mainstream. Goldman Sachs has been reporting technical analysis for a while (and been pretty damn accurate I might add; if this run stops at 3600 they'll be right again). Alphabet (Google) have an options market opening next month.

There is a wall of respectable money heading at this thing.

CNBC are starting to discuss it often

www.cnbc.com/video/2017/08/09/this-is-why-bitcoin-could-be-the-new-gold-tom-lee.html

Its going beserk evil panda there are some real winners amongst it however there are also a couple sliding down the chart into oblivion......

I have been reading clif high reports he is somewhere between a genius and a lunatic..

Looking at just bitcoin (as I do) the recent "bubble" isn't nearly as "bad" when you look at it using a logarithmic scale: www.blockchain.com/charts/market-price?timespan=all&scale=1

www.blockchain.com/charts/market-price?timespan=all&scale=1

Logarithmic makes more sense; between dates A and B it went up 10x, between dates C and D it went up 10X.

It is compounding.

vs linear scale, which is how it is commonly shown: blockchain.info/charts/market-price?timespan=all

blockchain.info/charts/market-price?timespan=all

You could very well argue bitcoin is only "chugging along", historically speaking.

It's still early days. Mainstream is just catching on. Deflation hasn't even started (~16m of total 21m coins mined).

www.blockchain.com/charts/market-price?timespan=all&scale=1

www.blockchain.com/charts/market-price?timespan=all&scale=1 blockchain.info/charts/market-price?timespan=all

blockchain.info/charts/market-price?timespan=allIf you put anything that is growing on a linear scale it will eventually become infinitely steep (what's the word?) exponential. Anything. More so if you are looking at it from the beginning of (its) time.

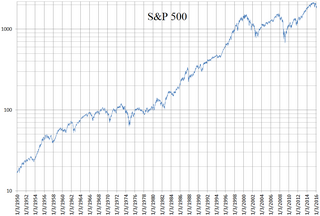

These charts are from 1950 - 2016.

S&P500 Linear:

S&P500 logarithmic:

Logarithmic shows percentage changes much better than linear. This is why most traders use logarithmic, much more so for something that has increased in value a lot over time. Linear is more useful for something that has been stable over a period of time.

Using the above examples the recent spikes look terrifying in the linear version, but looking at the logarithmic version you can see that historically they are quite normal.

It's more often about percentages, not raw value.

Is the Dow Jones in a worse bubble than bitcoin? Aaaaargh! Everything is in a bubble!!!! ![]()

Of course not. Linear is the wrong chart to use.

Wikipedia gets it right: en.wikipedia.org/wiki/Dow_Jones_Industrial_Average

Blockstream in Space:

blockstream.com/2017/08/15/announcing-blockstream-satellite/

Use case:

Downloading blockchain to sign offline transactions.

Logarithmic shows percentage changes much better than linear. This is why most traders use logarithmic, much more so for something that has increased in value a lot over time. Linear is more useful for something that has been stable over a period of time.

Totally agree evlPanda - this has absolutely nothing to do with confirmation bias.

If you double 100, you get 200, and increase of 100

If you double 1000, you get 2000, and increase of 1000

Both examples of doubling end up with 10 fold ratio in absolute change.

The "semi-log plot" removes this aberration.

Firstly pod charts and a useful bit of information, epic...

second the total market is over 140 billion which is double from start of this thread.....![]()

This is crazy right now.

What to make of the oscillations that are going to happen between mining bitcoin (btc) and bitcoin cash (bcc) as the difficulty and profitability keeps adjusting?

I don't think anyone knows, nor possibly could know.

This is crazy right now.

What to make of the oscillations that are going to happen between mining bitcoin (btc) and bitcoin cash (bcc) as the difficulty and profitability keeps adjusting?

I don't think anyone knows, nor possibly could know.

I just hope you are not that character in that free-falling truck ?

That's my bitcoin.

Depending on how you look at it either 1 btc still equals 1 btc, or the $AUD has lost about 45% of its value since this thread started; from 0.00035 btc to 0.00019 btc. Thankfully mine is mostly debt.

Hey buster I agree but now all the bankers are jumping in and either starting up or advising or buying in.

there are also now "portfolio" teams where you buy in and it's across the top 20.

Oh and you think ya super funds are safe.........google it ..

im in and riding the wave

Awsome razz .....Send us enough of your money and ill send you my new web address. That bubble gota burst.  The original bitcoin?

The original bitcoin?

Seems to me like clever marketing of the bitcoin seem to be creating a demand. Mabe jumping on the band wagon might work;-) But id place it in the category of "HIGH RISK" Feed your family first and pay of your mortgage!

Seems to me like clever marketing of the bitcoin seem to be creating a demand. Mabe jumping on the band wagon might work;-) But id place it in the category of "HIGH RISK" Feed your family first and pay of your mortgage!

Def HIGH RISK...

I've been playing with crytos since reading this thread a few months ago.

It's become a bit of a hobby/addiction, turned 2K into 5 - quite fun especially when your up.

I personally don't think blockchains are going to go away - any time soon.

so get your 2k back and run the 3k as milk money ? Play the game .\don't let it play you. Your money is an expendable bag of peanuts. Good luck to you anyways its not for me! NO_CONVERSATON_EXISTS

It's become a bit of a hobby/addiction...

Doesn't it? Been into it since about the start of this thread too, and right now I'm downloading the bitcoin chain preparing for a miner I bought : \

It's just a USB miner; a toy. I've calculated I'll lose $8/year on it. (better than lotto)

But running a full node gives me all the security and all the rights that come with that.

So yeah, it gets addictive. All the drama is pretty interesting too; the recent fork for bitcoin cash; sheesh!

^^ apparently lot of people in Russia got sucked into the mining for cryptos scam..

When I was in Moscow last Jan, saw the billboards like this one ![]()

![]()

"Don't Mine, Dad"

Actually Russia is one of few places where the electricity is cheap enough that you could turn a profit; about $AU0.07/kWh, often less. The cost of electricity is the main factor in mining profitability, you could never do it here.

How would a mining scam even work? Dad buys a miner, sets it up, and ...what? I'm genuinely curious. Please tell me.

Mining is using cryptography to encrypt a block of transactions, which then get added to the blockchain. It's relatively simple mathematics. It can be done with pencil and paper, albeit very slowly.

www.righto.com/2014/09/mining-bitcoin-with-pencil-and-paper.html < the video fast forwards many times, so is watchable.

It takes a few seconds to calculate if you will be profitable or not. It's no secret.

There are hundreds of these: www.coinwarz.com/mining/bitcoin/calculator

----------------

...It's no secret.

I wonder if that is what people are not understanding. It's ALL open source. Everything. All of the code for Bitcoin, the wallets, whatever is all open source. That means you can read, copy, modify all the code, do whatever you want with it. (your copy of it)

Here is, literally, Bitcoin: github.com/bitcoin/bitcoin

A decade or more ago open source was written off, now it powers almost everything. The internet. Your phone. Microsoft, Oracle et al have all embraced it. It is, paradoxically, much safer.

More open source empowering the future: www.emojicode.org

"How would a mining scam even work? Dad buys a miner, sets it up, and ...what? I'm genuinely curious. Please tell me."

The mining rigs sellers promise 350% return..

Dad (usually poor) needs about1,3M rubles to buy..he borrows or sells his parents home or sells his kidney etc..