. cant loose what you haven't got . Bitcoin Like might aswel go down to the casino and throw your hard earned assets on black or red. You need to be pegged down before you lose it all. my fambily worked to hard for our assets. be ****ed im gona gamble it . . Your borrowing money you don't have to invest in a false currency . You understand whats happening here? Banks will take your house and repossess anything you own. They don't give a **** about your bit coin investments. You understand the risk involved here?These ****s that are lending you money don't give a **** if your family is broke homeless.

Sell everything and put all your money into bitcoin. You and your family live like homeless people.

If it all goes to zero you are already prepared.

Well Im out!

51% in a month is enough for me thanks very much! Just getting too crazy now and when she drops itll be pretty damn rapid I reckon.

Guess Im a "normie" again ![]()

I just keep wondering how Crypto's hand became so strong? ![]()

LOL

Its a pity the market is clearly so dysfunctional as i really like the idea of bitcoin as an alternative to money printing fiat currencies in the long run but you have to divorce the technology from the market to my way of thinking and the kind of price action we have seen this month will eventually destroy the one thing BTC has - Trust.

No one seems to have a clue why the price moves other than with tea leaf reading technical "analysis". Fair value as it applies to all other financial markets is a non starter.

Take away trust in the market price being efficiently determined and its a house of cards. Hopefully the market can mature before this happens.

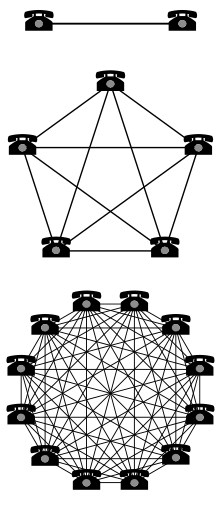

Metcalfe's Law

states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

Coinbase, the largest exchange, has upwards of 50,000 new users ...per day.

www.coinbase.com/about

The law has often been illustrated using the example of fax machines: a single fax machine is useless, but the value of every fax machine increases with the total number of fax machines in the network, because the total number of people with whom each user may send and receive documents increases. Likewise, in social networks, the greater number of users with the service, the more valuable the service becomes to the community.

The Bell Curve of Technology Adoption

imgur.com/0chcgLX

You can see this throughout history. Note that it gets faster.

imgur.com/uQrbmtM

Source: medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da

Bitcoin is the Linux of internet money. Eventually you won't even know it is there.

In more exciting news:

Electrum 3.0 is out. SegWit addresses are supported.

electrum.org/#download

Metcalfe's Law

states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

Coinbase, the largest exchange, has upwards of 50,000 new users ...per day.

www.coinbase.com/about

Panda - Metcalfes law if you wanted to use it would be used to value the exchange not the currency ie its about the velocity of transactions if you like.

If I suspend that though are you asserting that BTC value increases as the number of holders increase? (limited supply increasing demand?) If so then there would need to have been a near doubling of new users in the last few months to justify the price increases (assuming some kind of linear relationship).

I doubt thats the case in fact a whole bunch of chinese went offline in this period. No I think something else is at play at least in the short to medium term and what worries me is that even in hindsight no "expert" has a clue what those drivers are.

eg if crude spiked by just 20% in a sustained way while it might not have been entirely clear at the beginning of the rally why it did it would be very clear what happened in hindsight ie withdrawal of supply or whatever.

Like I said the shame of it will be if enough of the newcomers get hurt in a bubble (which no one knows if it is or not) then the trust will be eroded and if the bubble and ensuing crash is big enough it could wipe out that requisite trust for good. And that would really suck as then we are left with paper money or gold again.

Panda - Metcalfes law if you wanted to use it would be used to value the exchange not the currency ie its about the velocity of transactions if you like.

Bitcoin is peer-to-peer. The exchange is not in the picture.

If I suspend that though are you asserting that BTC value increases as the number of holders increase? (limited supply increasing demand?) If so then there would need to have been a near doubling of new users in the last few months to justify the price increases (assuming some kind of linear relationship).

It is not linear. It is the number of connections, not nodes.

n(n ? 1)/2

If there are 5 users/nodes then the network's value is 5(5 - 1)/2 = 10.

10 nodes = 10(10-1)/2 = 45

15 nodes = 15(15-1)/2 = 105

20 nodes = 20(20-1)/2 = 190

China was overrated. China has alternatives that are far more popular than bitcoin.

No I think something else is at play at least in the short to medium term and what worries me is that even in hindsight no "expert" has a clue what those drivers are.

Today, and the last couple days, is clearly hype. It's all very exciting. It'll pull back again for sure.

But, there is a slow and steady average that is only generating even more hype. Fear of missing out comes into play. Greed. And so on.

Also, it was Bitcoin's birthday yesterday. Might have played into it.

eg if crude spiked by just 20% in a sustained way while it might not have been entirely clear at the beginning of the rally why it did it would be very clear what happened in hindsight ie withdrawal of supply or whatever.

Honestly no idea. There is no underlying factor like supply, or weather, or even competition. The price is in many ways very, very pure; based on the illusion of money in its most pure form.

Like I said the shame of it will be if enough of the newcomers get hurt in a bubble (which no one knows if it is or not) then the trust will be eroded and if the bubble and ensuing crash is big enough it could wipe out that requisite trust for good. And that would really suck as then we are left with paper money or gold again.

A very real possibility. Suicide hotlines again.

Don't risk more than you are willing to lose.

Its a pity the market is clearly so dysfunctional as i really like the idea of bitcoin as an alternative to money printing fiat currencies in the long run but you have to divorce the technology from the market to my way of thinking and the kind of price action we have seen this month will eventually destroy the one thing BTC has - Trust.

No one seems to have a clue why the price moves other than with tea leaf reading technical "analysis". Fair value as it applies to all other financial markets is a non starter.

Take away trust in the market price being efficiently determined and its a house of cards. Hopefully the market can mature before this happens.

WTF. People decide the value of things. Something/Anything is only worth what someone else is prepared to pay for it at a point in time. It's people who are dysfunctional not crypto.

What do you mean about bitcoin losing trust? The trust in bitcoin is inherent to it's design. The trust comes from mathematics, specifically the cryptography. That's why crypto currencies/blockchain is not going away anytime soon. It's a significant invention.

The price of Bitcoin was the same as the price of one ounce of gold in March this year. Today one Bitcoin will buy you over five ounces of gold. Bitcoin is definitely moving towards a "store of value". I doubt you will ever buy a meal or a coffee with Bitcoin, but I'm sure in five or so years you will be able to buy everyday items with crypto. I just wish I knew which one it's going to be.

Institutional investors are coming into the mix now. They are just taking profits from the stock market and beginning to speculate on crypto in small percentages.

This market has a long way to go - early days still.

I sold all my bitcoin today - when any coin behaves like a man that hasn't had sex for three months it sends me a SELL signal.

I'm hoping to buy back in to it when the "normies" start jumping on it at the top. Then I will buy back into it incrementally as the weak hands let go of the tree - allowing the strong hands make more profit - lol

On the one hand I really do want to emphasise it is an experimental currency. That is a fact acknowledged by all the developers.

And I want to emphasise, again, don't risk more than you are willing to lose.

But on the other hand I want to point to the Lightning Network and say "You ain't seen nothing yet."

: |

it would be interesting to know the top 100 owners of bitcoin by value. To see if it is some cartels from Mexico or swiss banking types dropping large sums into the system. No one will know though.

Obviously the bitcoin production cant keep up, hence the value increase as everyone jumps onto it.

as I thought, an address tag, hiding a broker, hiding a corporation, hiding a trust, hiding another corporation, hiding someone who is not traceable any where

so much better than a swiss bank account

let the S curve continue

Would you use a currency that identifies you publicly?

Fark me some of you normies have absolutely no idea - lol

Its a pity the market is clearly so dysfunctional as i really like the idea of bitcoin as an alternative to money printing fiat currencies in the long run but you have to divorce the technology from the market to my way of thinking and the kind of price action we have seen this month will eventually destroy the one thing BTC has - Trust.

No one seems to have a clue why the price moves other than with tea leaf reading technical "analysis". Fair value as it applies to all other financial markets is a non starter.

Take away trust in the market price being efficiently determined and its a house of cards. Hopefully the market can mature before this happens.

WTF. People decide the value of things. Something/Anything is only worth what someone else is prepared to pay for it at a point in time. It's people who are dysfunctional not crypto.

What do you mean about bitcoin losing trust? The trust in bitcoin is inherent to it's design. The trust comes from mathematics, specifically the cryptography. That's why crypto currencies/blockchain is not going away anytime soon. It's a significant invention.

The price of Bitcoin was the same as the price of one ounce of gold in March this year. Today one Bitcoin will buy you over five ounces of gold. Bitcoin is definitely moving towards a "store of value". I doubt you will ever buy a meal or a coffee with Bitcoin, but I'm sure in five or so years you will be able to buy everyday items with crypto. I just wish I knew which one it's going to be.

Institutional investors are coming into the mix now. They are just taking profits from the stock market and beginning to speculate on crypto in small percentages.

This market has a long way to go - early days still.

I sold all my bitcoin today - when any coin behaves like a man that hasn't had sex for three months it sends me a SELL signal.

I'm hoping to buy back in to it when the "normies" start jumping on it at the top. Then I will buy back into it incrementally as the weak hands let go of the tree - allowing the strong hands make more profit - lol

You completely miss my points crypto. All I'm saying is the market as at risk of losing trust in its ability to set rational prices. Add extreme intraday volatility and many will shy away once they get hit by some big negative swings. Reason being is because buyers will have no faith they are getting a roughly fair price.

I'm separating trust in the market from trust in the technology (which for now seems robust I agree )

As for the instos one thing I do know in all this is they will only put "other peoples money" into bitcoin for now and the reason for that is because they can't identify a fundamental value for it. Without that they simply will never get approval to take significant proprietary positions. They will trade for edge though and through that provide more market efficiency and liquidity.

At least I got the call to sell today in agreement with you so we are on the same page there.

Another thing I find interesting is the way poker terms like strong hands weak hands, whales etc come into the crypto speculator lingo. I reckon that is pretty appropriate to how this "market" is more akin to a giant game of poker than an actual financial market.

Again I'm talking about the market not the actual bitcoin themselves but without a functional market bitcoin will eventually fail.

Like you though I'll be back on the bid after a decent correction.

Its a pity the market is clearly so dysfunctional as i really like the idea of bitcoin as an alternative to money printing fiat currencies in the long run but you have to divorce the technology from the market to my way of thinking and the kind of price action we have seen this month will eventually destroy the one thing BTC has - Trust.

No one seems to have a clue why the price moves other than with tea leaf reading technical "analysis". Fair value as it applies to all other financial markets is a non starter.

Take away trust in the market price being efficiently determined and its a house of cards. Hopefully the market can mature before this happens.

WTF. People decide the value of things. Something/Anything is only worth what someone else is prepared to pay for it at a point in time. It's people who are dysfunctional not crypto.

What do you mean about bitcoin losing trust? The trust in bitcoin is inherent to it's design. The trust comes from mathematics, specifically the cryptography. That's why crypto currencies/blockchain is not going away anytime soon. It's a significant invention.

The price of Bitcoin was the same as the price of one ounce of gold in March this year. Today one Bitcoin will buy you over five ounces of gold. Bitcoin is definitely moving towards a "store of value". I doubt you will ever buy a meal or a coffee with Bitcoin, but I'm sure in five or so years you will be able to buy everyday items with crypto. I just wish I knew which one it's going to be.

Institutional investors are coming into the mix now. They are just taking profits from the stock market and beginning to speculate on crypto in small percentages.

This market has a long way to go - early days still.

I sold all my bitcoin today - when any coin behaves like a man that hasn't had sex for three months it sends me a SELL signal.

I'm hoping to buy back in to it when the "normies" start jumping on it at the top. Then I will buy back into it incrementally as the weak hands let go of the tree - allowing the strong hands make more profit - lol

You completely miss my points crypto. All I'm saying is the market as at risk of losing trust in its ability to set rational prices. Add extreme intraday volatility and many will shy away once they get hit by some big negative swings. Reason being is because buyers will have no faith they are getting a roughly fair price.

I'm separating trust in the market from trust in the technology (which for now seems robust I agree )

As for the instos one thing I do know in all this is they will only put "other peoples money" into bitcoin for now and the reason for that is because they can't identify a fundamental value for it. Without that they simply will never get approval to take significant proprietary positions. They will trade for edge though and through that provide more market efficiency and liquidity.

At least I got the call to sell today in agreement with you so we are on the same page there.

Another thing I find interesting is the way poker terms like strong hands weak hands, whales etc come into the crypto speculator lingo. I reckon that is pretty appropriate to how this "market" is more akin to a giant game of poker than an actual financial market.

Again I'm talking about the market not the actual bitcoin themselves but without a functional market bitcoin will eventually fail.

Like you though I'll be back on the bid after a decent correction.

Yup, agree. One great big exciting game. That's not that difficult to play. Well the last 4 months have been phenomenal.

I keep a small percentage to trade the wild swings with tight stops on coins with major volumes. So I enjoy the volatility. There are plenty of opportunities. I've had really good luck just jumping on coins that are being shilled in telegram chat groups and on 4chan/biz

80% of the time these rumours spread in the groups turn out to be true, probably just human psychology. A reliable source of pumps is the Palm Beach Confidential, but there are many others.

At least I got the call to sell today in agreement with you so we are on the same page there.

Ah, that's why it shot up. Mystery solved.

This was a good, deep read.

What Will Bitcoin Look Like in Twenty Years?

hackernoon.com/what-will-bitcoin-look-like-in-twenty-years-7e75481a798c

interesting reading

its like an experiment, for some future system, that needs a lot of work to get to

"Today the Bitcoin network is restricted to a sustained rate of 7 tps (transactions per second) due to the bitcoin protocol restricting block sizes to 1MB. "

"Basically, it's the Model T of the blockchain revolution."

Lol, could be a freeze as the herd try and get out. Supposedly they can scale it up.

And I'll just drop this here (MasterLuc aka Lucifer, aka Bitcoin Vanga, aka PentarhUdi).

Nice bit of analysis there done in MS Paint. Haha.

Bitcoin will correct by around 33% starting some time in the next few days![]()

PS: I just recently read an article about blockchain/DLT which highlights that not only does it remove the need for a third party financial institution for a currency transaction, it can remove the need for any legal involvement as well. This may have a huge impact as so much of the "modern world" revolves around the law - every company today exists on a legal basis, so even this may be threatened.

Quite possibly the worst thing I've ever seen. Crypto is so much fun.

Bitcoin will correct by around 33% starting some time in the next few days![]()

PS: I just recently read an article about blockchain/DLT which highlights that not only does it remove the need for a third party financial institution for a currency transaction, it can remove the need for any legal involvement as well. This may have a huge impact as so much of the "modern world" revolves around the law - every company today exists on a legal basis, so even this may be threatened.

You have that article? Sounds very interesting indeed.

I'll still have my 50bucks ;-)

At the time you made you bet aud/xbt was 0.00014. Is now 0.00010.

Your $50 is now worth $35.70.

I didn't adjust for inflation.

We can keep doing this for years. There'll be ups and downs, but there's a general trend. Acceptance is growing. Tech is improving.

All the while your money is worth less and less and less (ignoring crypto).

If the Australian government makes its own cryptocurrency, as it is considering, it will make the exchange to the stronger currency even easier. If it bans it it will condemn its citizens to a worthless currency.

Right now we're seeing Gresham's Law; bad money drives out good. The good money is being hoarded (hodled).

WTF. People decide the value of things. Something/Anything is only worth what someone else is prepared to pay for it at a point in time. It's people who are dysfunctional not crypto.

People decide the PRICE of things. VALUE is something entirely different. The VALUE of an enterprise or investment can be calculated within a range depending upon your method. Price is what you pay, value is what you get.

I do agree however that people are dysfunctional when it comes to trying to make money. They always have been, and always will be.

Any WA people getting into Power Ledger.

Sounds very promising. I've been reading bits and pieces on it for a few weeks now.

www.powerledger.io

Apart from it's real world applications there were three other rumours I wanted to clear up - all seem somewhat true:

1. Trials with Orign Energy

2. Interest from Elon Musk

3. Chair is the Mayor of Perth

reneweconomy.com.au/origin-energy-trials-solar-trading-blockchain-start-power-ledger-91263/

www.huffingtonpost.com.au/2017/10/05/power-ledger-the-aussie-company-thats-using-blockchain-to-digitise-energy_a_23233202/

www.abc.net.au/news/2017-10-25/who-is-new-perth-deputy-mayor-jemma-green/9085746

It's almost a story that's too good to be true.

The other unsubstantiated rumour I heard is that it is going to be listed in the coming week on bittrex - if this happens price could easilly double again.

As has been mentioned before, a Cryptocurrency is a specific application of the Blockchain model.

But the beauty of the Blockchain IT application is that it is not owned by a person, a legal collective, a company or a government.

It appears to be an IT application owned and managed by its participants who exist all over the world (based on where the Internet reaches)

It has removed the need for third party involvement in any possible type of transaction.

No financial institution, no legal practitioner, no company, no government.

Just think in your own space what potential this concept makes possible.